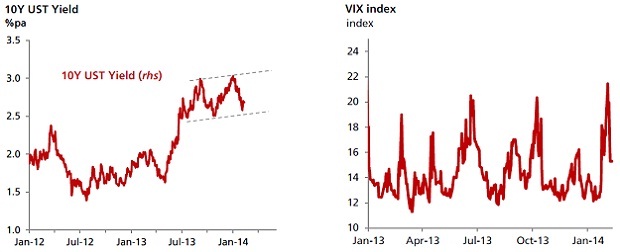

The yield on ten-year US Treasury rebounded to 2.68% from the recent low of 2.57% on February 3 as risk aversion receded. However, the upside on yields was capped by two consecutive months of lacklustre payrolls data.

Notably, when the January non-farm payrolls registered 113,000 (compared with a consensus forecast of 180,000), there was actually a temporary knee-jerk reaction that pushed the yield on ten-year US Treasury down to an intra-day low of 2.63% on Friday. As a result, the yield on ten-year US Treasury remains firmly in the lower half of the trend channel (see chart). Despite the seeming turn of risk appetite, the market is still factoring slightly elevated levels of implied volatility as represented by the VIX. As the VIX heads towards normal index levels (12-13), the negative risk premium effect on bonds should also ease, pushing the yield on ten-year US Treasurys back towards 3%.

For the medium term, it is clear that that labour data continues to have a very strong influence on US Treasury yield trajectory, but the market is no longer fixated on just the unemployment rate (which fell to 6.6%, just a notch above the 6.5% threshold).

Meanwhile, the suspension of the US debt ceiling has expired and the extraordinary measures are likely to be exhausted by February 27, according to US Treasury Secretary Jack Lew. Delays in lifting the debt ceiling could lead to a prolonged wave of risk aversion. A repeat of last year’s budget wrangling is already playing out with yields on the very front end of the US Treasury curve rising sharply. For this week, watch out for Federal Reserve Chair Janet Yellen’s inaugural semi-annual monetary policy testimony due Tuesday.